How to Find Manufacturing Overhead Applied

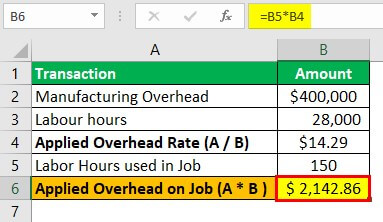

Then divide the manufacturing overhead costs by the allocation base. You can identify the total allocation base by reviewing the payroll records and the maintenance details of.

Applied Overhead Definition Formula How To Calculate

You can calculate applied manufacturing overhead by multiplying the overhead allocation rate by the number of hours worked or machinery used.

. While some of these costs are fixed such as the rent of the factory. By multiplying the cost of labor 5000 with the overhead rate of 025 the company can determine that the applied overhead for this job is 1250 to machine the parts and the total manufacturing cost is 13500. Manufacturing Overhead Rate 1200080000 x 100.

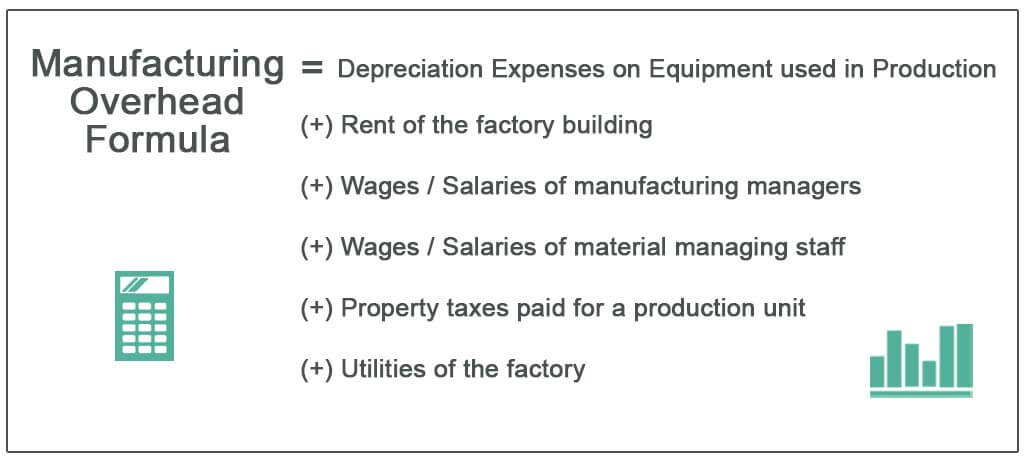

An example is provided which shows the calculation of a predetermined overhead rate wh. Below given is the formula that is used to calculate manufacturing overhead Manufacturing Overhead Formula Depreciation Expenses on Equipment used in. Manufacturing Overhead Rate Overhead CostsSales x 100.

How Do You Calculate Allocated Manufacturing Overhead. Calculate the total manufacturing overhead costs. Outsource certain aspects of the manufacturing process or bring various elements back in-house.

The under-applied overhead has been calculated below. If your overhead allocation rate is 100 per machine hour then multiply 100 times the number of machine hours for. In order to know the manufacturing overhead cost to make one unit divide the total manufacturing overhead by the number of units produced.

With a manufacturing overhead of 300000 and 27000 labor hours using the formula accountants can calculate this applied overhead rate. If a particular job used only 200 of those total labor hours accountants could calculate the applied overhead for that particular job by multiplying the labor hours of that job by the applied overhead rate. By dividing 500000 by 2000000 the company has arrived at a predetermined overhead rate of 025.

Depreciation on equipment used in the production process. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production during a reporting period. Direct costs are the costs that.

In our example manufacturing overhead is under-applied because actual overhead is more than applied overhead. Once youve added all your overhead costs together you need to figure out the manufacturing overhead rate. This overhead is applied to the units produced within a reporting period.

This is different from the manufacturing overhead applied formula because its expressed as a percentage. This video explains the process for applying manufacturing overhead. Suppose you start the year with 25000 worth of WIP and incur 300000 in manufacturing costs.

The total manufacturing overhead of 50000 divided by 10000 units produced is 5. Manufacturing Overhead Depreciation Salaries of Managers Factory Rent Property Tax. Because manufacturing overhead is applied at a rate of 30 per direct labor hour 180 30 6 hours in overhead is applied to job 50.

Under-applied manufacturing overhead Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process 108000 100000 8000. Here the allocation bases are the labor hours that are needed to produce the product from the beginning to the final step. The overhead rate is calculated by adding your indirect costs and then dividing them by a specific measurement such as machine hours sales totals or labor costs.

Recording the application of overhead costs to a job is further illustrated in the T-accounts that follow. What is Fixed Manufacturing Overhead Applied. The allocation base is the basis on which a business assigns overhead costs to products.

Manufacturing overhead is all indirect costs incurred during the production process. How do you calculate applied manufacturing overhead. There is no efficiency variance for fixed manufacturing overhead.

As it takes 4 hours to produce one bicycle the overhead per unit should be 15 x 4 60unit. In the previous post we discussed using the predetermined overhead rate to apply overhead to jobs. Calculate the difference between applied overhead and actual overhead.

So if your allocation rate is 25 and your employee works for three hours on the product your applied manufacturing overhead for this product would be 75. The journal entry to reflect this is as follows. This applied overhead rate can now be used for job costing as well as for calculating the estimated manufacturing overhead for the year.

An informed and realistic view of your fully-burdened labor costs will also help you determine whether you should. The formula is the WIP beginning balance plus manufacturing costs minus the cost of goods completed. The preceding entry has the effect of reducing income.

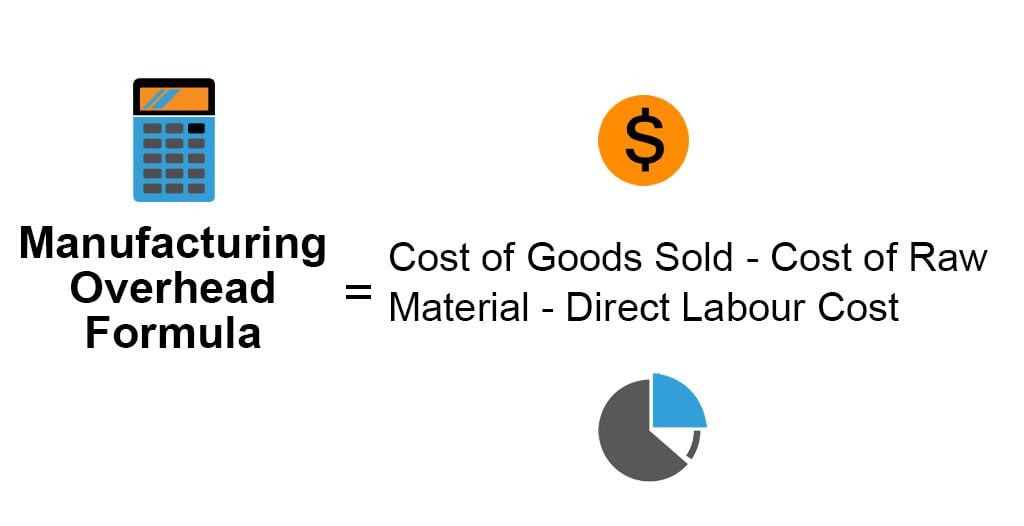

After that multiply by 100 so that the percentage is 15 of all sales. The cost of completed goods comes to 305000. You can calculate it by adding Dire.

Hire and train new workers to take on excess workloads tasks andor. Before you can calculate manufacturing overhead for WIP you need to determine the WIP ending balance. Manufacturing overhead is also known as factory overheads or manufacturing support costs.

For example if variable overhead costs are typically 300 when the company produces 100 units the standard variable overhead rate is 3 per unit. Manufacturing Overhead per unit. Manufacturing Overhead is calculated using the formula given below.

Calculate the manufacturing overhead costs. The manufacturing overhead rate formula is Manufacturing Overhead Rate Overhead Costs Sales x 100. Select an allocation base.

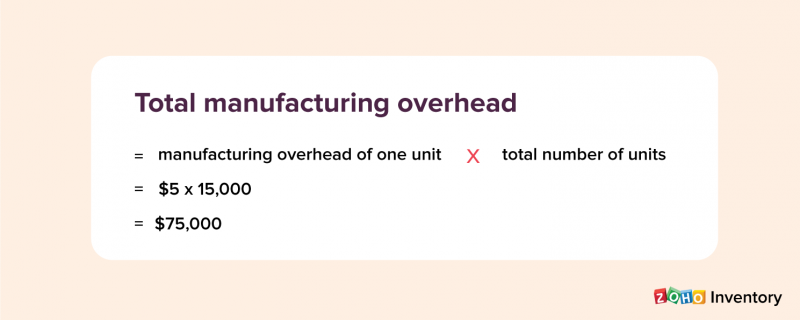

So for every unit the company makes itll spend 5 on manufacturing overhead expenses on that unit. Which is part of its production costProduction CostProduction Cost is the total capital amount that a Company spends in producing finished goods or offering specific services. If the overhead application rate is based on actual fixed costs incurred then the amount of overhead applied should match the amount incurred.

Examples of costs that are included in the manufacturing overhead category are as follows. This calculation can describe the amount of money spent on manufacturing overhead costs. In the company there are certain costs such as rent cost insurance premium cost salary to administrative staff etc.

Multiply the overhead allocation rate by the actual activity level to get the applied overhead for your cost object. Direct Labor Cost Method. The fixed overhead production volume variance is the difference between budgeted and applied fixed overhead costs.

Applying Manufacturing Overhead Youtube

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Calculator With Excel Template

Comments

Post a Comment